We always have discussions regarding the ever-increasing prices of basic commodities that we face every day in our lives, be it the increasing prices of crude oil products or that of a single loaf of bread. Taking a simple example of a single loaf of bread which used to cost mere Rs.15 costs somewhere in the range of Rs.40 now. Ever wondered why such a steep increase in price over such a short horizon. This is where the concept of inflation comes into the picture.

Definition of Inflation

When there is an increase in the prices of goods and services in the economy, over a given time horizon it is termed as 'Inflation.'

Inflation is a generic term where prices of a single good or service do not constitute inflation, but it is an increase in the prices of a basket of goods and services in the economy as a whole.

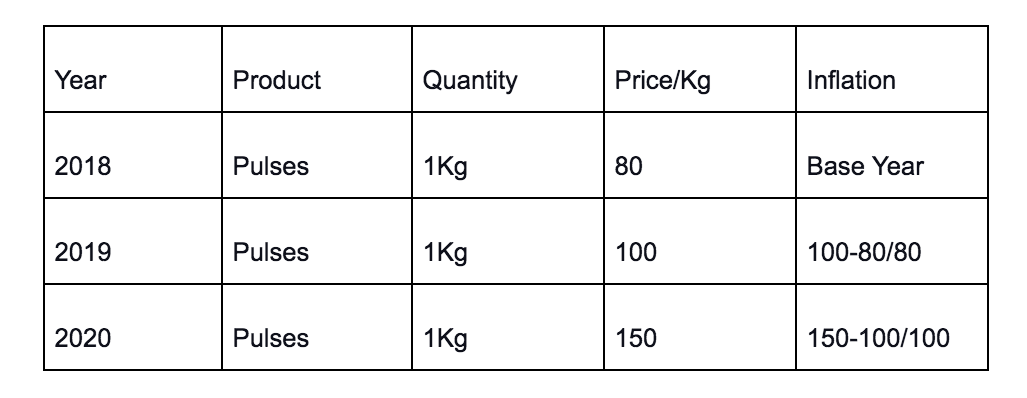

Inflation Chart

What is Inflation?

Inflation may be a method during which the price level is rising and ash is losing value. Inflation may be a rise within the indicant, not within the worth of selected goods.

There is a broad distinction in inflation and shifting trends:

Shifting Trends: We always come across trends where there is a sudden spike in demand for a particular product. Earlier we all have come across a phase where there was a huge demand for keypad phones, the prices of the phones also rose considerably, with the introduction of the new touch screen market the entire demand shifted to these phones and the prices of these touch screen phones started to rise. Thus this trend isn’t termed as Inflation but coined as shifting of trends because it is for a particular segment of goods and not consistent across industries.

For Example:

There’s a huge harvest of wheat so people start eating more wheat and less rice, leading to increasing prices of wheat and falling prices of rice, that's not "Wheat inflation" and "Rice deflation."

It is called the shifting of tastes.

Causes of Inflation

There are two main factors which are solely responsible for causing inflation:

• Demand-Pull Inflation Theory: Demand-pull inflation occurs when demand for a good or service increases so much that it outstrips supply. Due to the increase in demand, goods are sold out of price thus disrupting potential customers. The sellers start to increase production and constraint the outflow of goods at the same time thus increasing prices which in turn increase Inflation.

• Cost-Push Inflation Theory: Higher production costs and rising prices of raw materials lead to cost-push inflation. In cost-push inflation, the supply of the goods is hindered due to a considerable increase in the rise in production costs.

There are two main sources of increased costs:

1. Wage Rates

2. The monetary value of raw materials (Eg: Oil)

Types of Inflation

• Credit Inflation: When there is more money supply in the economy than needed due to more loans and advances being sanctioned by banks and private institutions than there is a price rise due to credit expansion.

• Currency Inflation: This type of inflation is caused by the printing of excess amounts of currency notes, thus increasing the money supply in the economy.

• Creeping inflation: In this type of Inflation, the price rises very slowly over some time. The growth rate of inflation is in single digits or when the prices rise 3% a year or less. This type of inflation makes the consumers aware that there will be a future trend of rises in price.

• Galloping Inflation: When Inflation rises to more than 10% in the economy leading to disruptions in purchasing power and has adverse effects on the economy is called galloping Inflation. Here the domestic currency loses its purchasing power and thus the business and income are unable to match the costs and prices. FDI resists investment in the country and the government also loses credibility.

• Stagflation: In simple words, stagflation means inflation + unemployment.