In this chapter, let’s talk about GST and what it means. India is notorious for its complex tax systems. This problem gets even more aggravated when constant changes are made to taxes with each financial year. But things changed with the new Goods and Services Tax, commonly known as GST, implemented in the Goods and Services Act, 2017.

Features of GST

- GST is a consumption-based tax which is levied on sale, manufacture and consumption of goods and services at a national level.

- The tax system takes the form of dual GST which is concurrently levied by the Central and State government. This will comprise of Central GST (CGST), State GST (SGST) and Integrated GST (IGST).

- In the case of intra-state transactions, the seller collects both CGST and SGST from the buyer. In the case of inter-state transactions, IGST is levied, which will be collected by the central government.

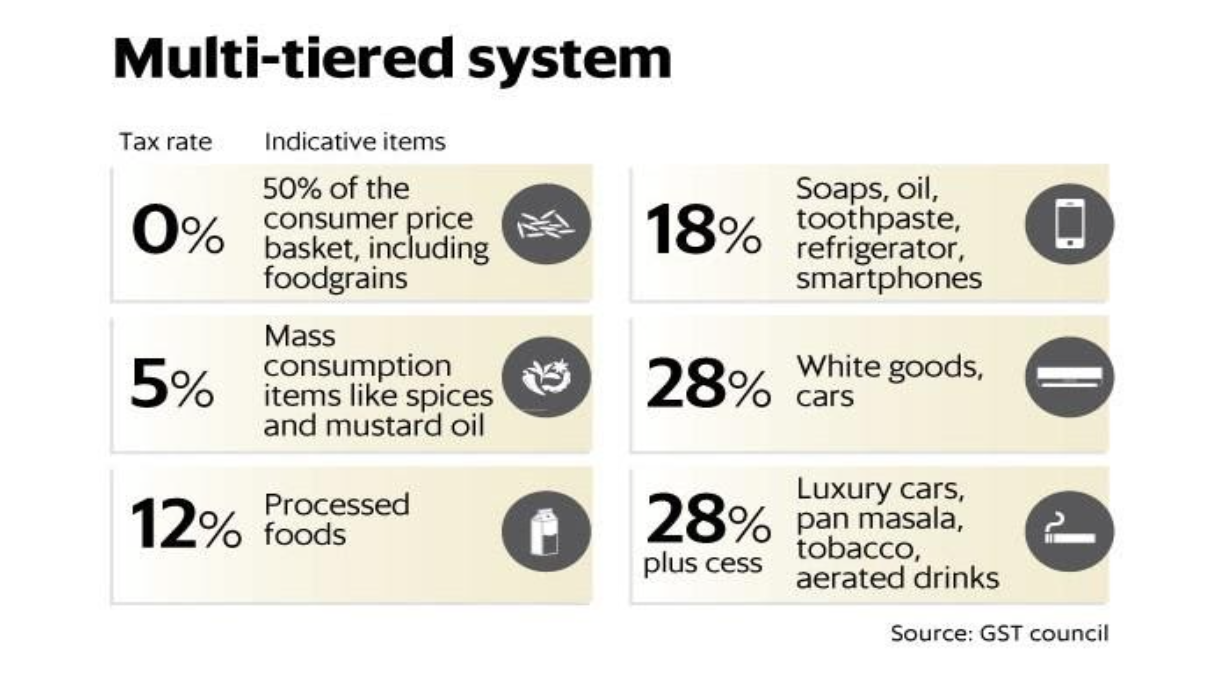

- The below chart depicts the GST rates for different goods:

Example of GST

Mr. A has his soap business in Mumbai. He sold soaps to Mr. B in Nasik. In this case, Mr. A and Mr. B, both are from Maharashtra. Hence, Mr. A will charge CGST and SGST of 18% from Mr. B, which gets split into two equal parts i.e 9% CGST and 9% SGST. Let’s say, Mr. A had sold the goods to Mr. B in Indore. In this case, Mumbai and Indore are in two different states. Hence, Mr. A will charge IGST of 18% from Mr. B.

Few Benefits of GST

- Eliminates Tax on Tax- A product sold from a seller from Mumbai to a buyer in Pune, CGST and SGST is to be added. Now again the same product is being sold from Pune to Chennai. This is an inter-state transaction, so IGST is applicable now. But isn’t this tax on tax again? A tax has already been paid on the product in the form of CGST and SGST. So the buyer in Chennai gets a tax credit and IGST gets reduced with the amount of CGST and SGST. This prevents the buyer from paying tax on tax.

- Eliminates Other Indirect Taxes– Post implementation of GST, only one indirect tax has to be paid by the trade and industry and all other indirect taxes like sales tax, purchase tax, service tax, octroi, etc. will be absorbed in GST.

- Ease of Business - The complex tax structure in India was a big hindrance to entrepreneurs. GST has eliminated this problem. Now, one can pay GST online and also file their returns online on the GST website.

- Reduces Flow of Black Money in the Economy- Black money is money on which taxes have not been paid to the government. With GST, to claim tax credit on the previously paid tax, everyone insists upon getting invoice or bills for transactions. GST will have a paper trail which can be accessed by the income tax department. This reduces corruption.

What is Investment Tax?

Have you ever wondered what could be the tax impact on the transfer of an asset? Assets you be anything ranging from property, bank deposits, mutual funds to stocks. Let us begin by understanding investment income. Investment income has three components:

- Interest Income- It is generated when you lend money to someone and make interest income on the money you lent. Generally, you get interest income from bank deposits, bonds, government securities and other debt instruments. The tax rate on interest income is different for different investment instruments. For eg: In case of Savings Account, interest income up to Rs. 10,000 is exempted from tax for people aged 60 years or less and Rs. 50,000 for senior citizens. For interest income more than Rs. 10,000, the tax rate is applicable as per the tax slab defined by Finance Ministry.

- Dividend Income- If you invest in equity/debt mutual funds or directly in stock markets, the company pays you a part of their profits, called dividends. While dividend income is tax-free for you, the company/scheme pays dividend distribution tax on it. And this tax is deducted from the amount available for sharing as dividends, so it reduces the amount you finally get. For equity funds, the tax rate is 11.64% including surcharge and cess and 29.12% for debt funds.

- Capital Gains- What is capital gain? Capital gains are the profit you make when you sell any investment. For eg: IF you invested Rs. 50,000 in a mutual fund and it grew to Rs. 75,000, when you redeemed, then Rs 25,000 is the capital gain (Redeemed Amount – Invested Amount = Capital gains). The current taxation rule divides capital gains into two different buckets:

- Short Term Capital Gains (STCG) – What does short term capital gain mean? If you sell your investment within 12 months, the gains on selling them are treated as short-term capital gains (STCG) and taxed at ordinary income tax rates. For eg: You invested Rs. 35,000 in an equity mutual fund on 25th April 2019 and redeemed it with a value of Rs. 50,000 on 22nd Feb 2020. Since the fund was held for less than 1 year, gains realized from this proceeding will be treated as STCG and you will pay a tax @ 15% on Rs. 15,000, that would be Rs. 2,250, plus 4% health and education cess.

- Long Term Capital Gains (LTCG) – Investments held for more than 12 months, are treated as Long Term Capital Gains (LTCG) and are taxed at 0%, 15%, 20%, depending on the taxable income. For eg: If you invested Rs. 50,000 in equity mutual fund on 1st Jan 2019 and redeemed on 1st Feb 2020, you received Rs. 75,000 as redemption value. Now, your capital gain is Rs. 25,000. However, as you stayed invested for at least 12 months and the gains did not exceed Rs. 1 Lakh, you don’t need to pay any tax. Now suppose, you stay invested for 4 years and redeemed when your investment value was Rs. 1,75,000. Now, your capital gain is Rs. 1,25,000. Hence, you have to pay 10% on the amount exceeding Rs. 1Lakh, i.e 10% of 25,000 = Rs. 2,500 plus 4% health and education cess.

A good understanding of taxation and effective tax planning can help you in making right investment decisions thereby enabling you to save income and increase wealth.